As President Trump imposes tariffs on products from countries around the world, foreign governments are answering back with tariffs of their own.

China has targeted corn farmers and carmakers. Canada has put tariffs on poultry plants and air-conditioning manufacturers, while Europe will hit American steel mills and slaughter houses.

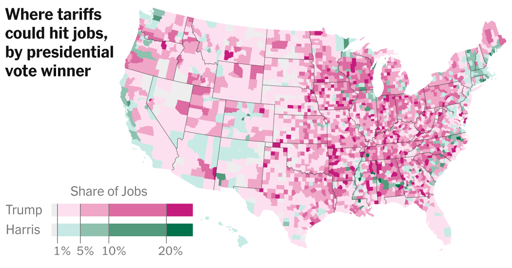

The retaliatory tariffs are an attempt to put pressure on the president to relent. And they have been carefully designed to hit Mr. Trump where it hurts: Nearly 8 million Americans work in industries targeted by the levies and the majority are Trump voters, a New York Times analysis shows.

The figures underscore the dramatic impact that a trade war could have on American workers, potentially causing Mr. Trump’s economic strategy to backfire. Mr. Trump has argued that tariffs will help boost American jobs. But economists say that retaliatory tariffs can cancel out that effect.

title butchers any meaning the article is attempting to convey

crab mentality is strong in the United States here of late with voters blaming each other for the destruction of the country when the ones that truly fund and run the country are the perpetrators that have Trump on a leash doing their bidding

only way out when civil disobedience, protests, and voting do not work is for us serfs to revolt

We must assuredly ‘all hang together’, or assuredly we shall all hang separately.

You’re correct. This is idiotic to think that un-tariffed spots will be left alone. Sorry, gang. We’re all paying for this idiocy.

Indeed, although I will concede, that the tariffs are designed to hit some areas more directly, and others more indirectly. But this will impact the economy as a whole, with financial capital most likely in the best position to gain (by potentially buying up assets from other sectors for cheap when they fail).